Only the Best Ideas, Solutions & Results

Employee Retention Credit (ERC)

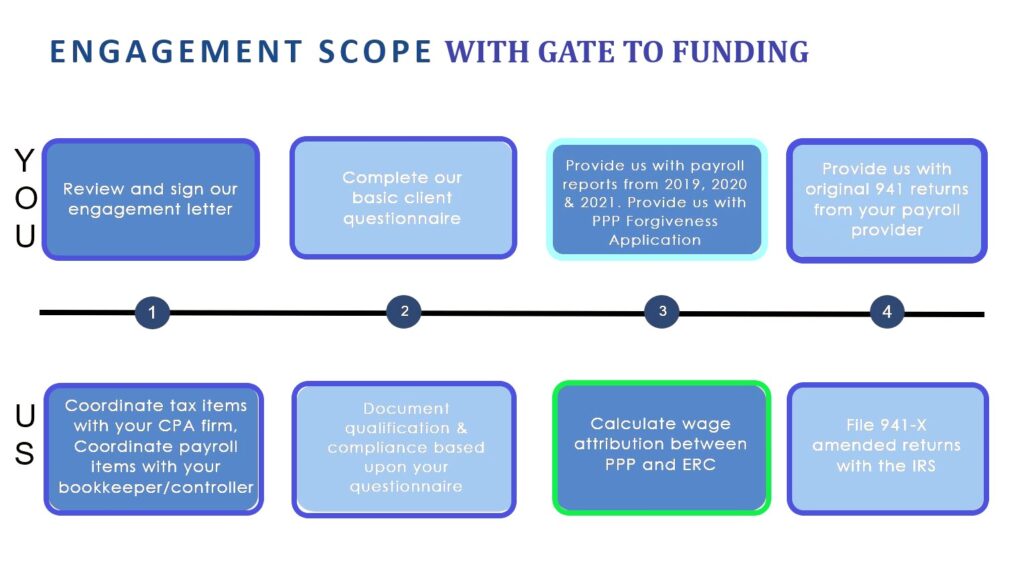

Let our team of experts ensure you maximize the credits you deserve from this Cares Act opportunity. We do nearly all the hard work for you with zero-risk.

An existing tax credit known as the ERTC

An existing tax credit known as the ERTC was available to businesses located in disaster-affected areas. Congress extended the program providing billions in economic stimulus supporting businesses negatively affected by the COVID pandemic that kept employees on their payroll.

It was created as a part of the CARES Act, which was approved by Congress in March 2020 and altered by the American Rescue Plan in 2021 and the Taxpayer Certainty and Disaster Tax Relief Act of 2020. The COVID Pandemic ERTC was essentially terminated with the passing of the Infrastructure Investment and Jobs Act of 2021, while credits may still be claimed.

Since this new regulation has undergone four changes, it is understandable that many professionals inadvertently give you bad advice that results in lost time and substantial payment credits that you are entitled to by law. Don’t miss your one chance to receive the payments you’re

How much money can I expect to reclaim?

The ERTC Refund cap for each employee is $26,000. Up to $7,000 per quarter, per employee, between January and September 30, 2021, is the maximum reimbursement for that year. The refund is determined by considering the 941 taxes paid, employer-provided health benefits, family leave for COVID, and paid time off to get vaccinated for COVID. A $5,000 credit per employee may also be available for 2020.

How can I qualify for the Employee Retention Tax Credit (ERTC)?

Your business needs to have been affected in at least one of two ways to qualify:

1. Your business experienced a 50% decline in gross receipts during any quarter in 2020 versus the same quarter in 2019 and/or a 20% decline in gross receipts during any quarter in 2021 versus the same quarter in 2019

2. Your business was forced to partially or fully suspend or limit operations by government order during 2020 or 2021. (This may include interrupted operations, supply chain interruptions, inability to access equipment or vendors, cutting hours of operation, etc.)

The qualifications have changed, even though your advisors have already studied and evaluated your circumstances. For 2020 businesses were capped at 100 employees and was expanded in 2021 to 500 employees. Our service is provided without charge to see if you currently qualify. Don’t let your company fail to receive this just compensation go unclaimed by your business.

Contact Info

- 20715 N Pima Road, Suite#108 Scottsdale, AZ 85255

- (623)-286-4869

- Info@gatetofunding.com